tv World Business Today CNN September 16, 2011 4:00am-5:00am EDT

4:00 am

much better understanding, i think, of what your brother was really like so i appreciate you spending the time. jermaine, thank you very much. >> thank you very much. >> been a pleasure. that's all for tonight. hello, i'm monita rajpal at cnn lon didn't. anti-gadhafi fighters say they are ready to seize and hold the town of sirte sometime today. moammar gadhafi was born there and the town remains loyal to him. fighters say they reached the heart of sirte thursday but retreated for the night. the palestinians have flown a symbolic chair to the united nations ahead of next week's general assembly. that's when palestinian authority president mahmoud abbas plans to make a bid for u.n. membership. abbas says the move is a done

4:01 am

deal but otherers indicate there may be room for compromise. state tv showed a soldier giving what it called a confession on thursday night. syrian activists are outraged and say the turkish government betrayed them by returning the soldier to syrian authorities. flooding in pakistan claimed more than 240 lives. the heavy rains that began falling in august have stopped for now but aid agencies in pakistan's government are struggling to help the victims. those are the top stories from cnn, the world's news leader. "world business today" starts right now. hello and a warm welcome. >> i'm nina dos santos at cnn london. these are the top stories on friday, september 16th.

4:02 am

finance ministers arrive for a high-level powwow in poland as they try to bring europe's debt crisis to a close. >> ubs, it reels from a fallout of a $2 billion loss. the swiss bank is facing a major overhaul. and a memo leaked to cnn warns of more job losses to come at rbs on top of 27,500 axed. the euro zone finance ministers meet in poland today. the hope is they'll show the same degree of unity and coordination that many of the world's key central bankers did on thursday in confronting europe's debt crisis. the central banks of britain, japan and switzerland move to pump dollars into europe's commercial lenders. it was all an effort to shore up liquidity. that's given stock markets a welcome boost.

4:03 am

nina, what are you seeing over there? >> yeah, manisha, broadly speaking they are up except for the cac 40, down by 0.25%. the green arrows demonstrate what could happen when the world central bankers get together and act in unity. that's particularly interesting because we'll see euro zone finance minister's meeting later today. we take a look at the impact of the cash injection on what it might mean for europe's debt crisis later on in the very show when we go over to jim bolden. this is how the markets are reacting, broadly speaking positive, with the exception of the cac 40 that just continues to fall as i talk. let's take a look at how the currency markets are faring. the euro is down by 0.5%.

4:04 am

the currency rose a full cent against the u.s. dollar when we had news about the concerted central bank action to pump more liquidity into euro zone banks. the pound has slipped against the green back in today's session, taking a look at the yen, that replains flat against the u.s. currency trading at 76. 6 at the moment. this thing you were eluding to, the idea that the central banks were coordinated and if we see the same thing from eco fin, that would be a great booster. the evidence shows coordinated action internationally is what the markets needed. a pep up here is very much an echo of what we're seeing in europe so far. i think the numbers can tell it all, really. you've got some indexes here where some the key bellwether stocks are exposed to that european market in particular. you have the nikkei, big exporting country there.

4:05 am

eyes on what's happening in the currency markets. a huge boost in sentiment given the action we saw from the central banks this week. obviously people are looking for more. another interesting thing to mention, gold. coming down more than 4.5% this week. gold, normally people flock to it in terms of uncertainty. interesting it should be pulling back this week, nina. >> interesting indeed. the fact that u.s. markets look set for a slightly lower open when trading begins. this is where we stand in terms of the premarket action. must stress we're a number of hours away from the opening bell on wall street. after some pretty substantial gains on some of the u.s. markets yesterday, because we had that con certified action coming out around about the time of the opening bell, that market seems poised for profit-taking, albeit down by about 0.3%. >> the inflow of cash into europe's beleaguered banks may

4:06 am

have lifted the markets but christine lagarde isn't mincing her words when it coming to describing the severity of the economic problems the world is facing. >> i was certainly living through very troubled time at the moment with great economic anxiety. exactly three years ago after the collapse of lehman brothers, the economy skies today look troubled. they look turbulent, as global activity slows and downside risks increase. we have entered into a dangerous phase of the crisis. >> you've been warned. lagarde says the global economy is mired in a crisis of confidence. and that the problem is being made worse by, quote, policy indecision and political dysfunction. she's calling on european leaders to take bold, collective action to deal with the debt problems that are threatening to strangle europe's already anemic economic recovery.

4:07 am

>> and ms. lagarde will have an eye on that meeting of the euro zone finance ministers in poland where the continent's debt crisis will be top of the agenda. timothy geithner will be joining those european finance ministers at that very get-together. that's an indication of just how seriously the united states is taking europe's sovereign debt problems. cnn's jim bolden is in poland and joins with us a preview of what's going on there and what we can expect. i had there, jim. lagarde, fighting talk from the former french finance minister whoin tre who interestingly enough was trueing to draw a consensus there this time last year. >> she is looking for a consensus or a consensus statement out of the people meeting here over the next two days. what's so interesting really is that the euro zone finance ministers have been meeting for several hours. they kicked off very early on friday morning. the reason for that they wanted

4:08 am

to have four or five hours of meetings with the euro group and go into the larger meeting with the others. it's going to be very important for the markets to get some sense that there is a sense that these people here will do something bold, some action, some words, maybe even more than words to go along with what we saw the central banks do. yesterday, the unity from the certa central banks. those meetings are already under way. then in the afternoon, that's when you see the imf and timothy geithner joining with the larger group. here's a bit of a preview of what we might expect. >> the finishing touches have been added to this convention center, ahead two of days of meetings between europe's financial big wigs. it's an informal meeting of the 27 eu finance ministers and central bank governors. they happen often and mostly go unnoticed. this time it's different.

4:09 am

the fear of greece defaulting on its debt have shined a bright light on this gathering and brought u.s. treasury secretary timothy geithner back to europe for the second time in a week, to the delight of the meeting's host. >> i think it's very important that he's coming. you'll have to talk to him about his intentions. we're extremely pleased. we think it's very important we have an outside view. >> the polish finance minister says the euro zone only has a matter of months to try and restore confidence in the euro, the very foundation of the european union as an institution. >> this is why we have to really mobilize ourselves and make sure none of these threats materialize. >> talk will not help greece pay its bills. the country's leaders vow they will meet deficit targets in order to get an already agreed upon second bailout. europe's finance ministers here will be asked if their countries will keep pushing for increased bailout funds for greece and

4:10 am

other indebted countries. these finance ministers remember all too well the financial market chaos caused by the failure ever lehman brothers investment bank three years ago this week. >> and nina, timothy geithner isn't just coming here to listen. there's a lot of talk on the wires that he's going to come with an idea, a plan similar to what they did in the u.s. after lehman's collapse, that they'd be able to help the bailout fund grow even larger and use the bailout fund in a more sophisticated way. meaning a lot more money would be available for greece, portugal and ireland. nina. >> more money, hopefully not too much more talk. jim bolden, from poland, where he's covering that all-important meeting. an internal memo leaked to cnn suggests that royal bank of scotland is about to cut even more jobs. this is on top of or potentially part of thousands that the company's already eliminating.

4:11 am

the e-mail was sent to staff at the bank's market division across europe, the middle east and also africa on thursday. and inside it, peter nielson, the global head of markets says and i quote, we are now pro-prosing further head count reductions across the market and gbm treasury group. i appreciate these would be unsettling times but would ask you to focus on execution and stay close to your clients since being handed the biggest bailout in financial history in 2008, this is a company that's announced no less than 27,500 layoffs worldwide over 21,000 of those will be across the united kingdom. since the credit crisis first started, the financial sector has been hemorrhaging jobs. european banks say the industry needs to shed about 270,000 positions, aside from the likes of rbs, hsbc already announced it will be cutting about 30,000

4:12 am

positions by the year 2013 when it comes to barclays and other uk lenders, it will be losing some 3,000 workers. and cnn's sources also say ubs is headed for a major shake-up after a lone trader allegedly ran up a multibillion dollar loss. insiders tell us this may be the catalyst for a sweeping overhaul at the swiss bank. that could include carving its investment and private banking businesses in two. all of this comes after derivatives trader was arrested in the uk on thursday. reuters and other british outlets identify him as kweku abodoli. his last message on facebook reads, need a miracle.

4:13 am

that account has since been removed from the site. to give you an idea of the amount of money here, ubs says it could put it in the red next quarter. it will also cancel out any savings that the bank hoped to make from the 3,500 job cuts made last month. nina? >> manisha, very unpopular times for investment banking. one former board member of ubs told me, quote, unquote, we all know the glory days of investment banking have gone and a lot of these job cuts at rbs, ubs, hsbc are often coming from the investment bank iing. subs now on review for a possible downgrade because it's worried about how this bank handles its risk. many people are wondering how that $2 billion trading loss actually slipped through the cracks. >> the products are so complicated these days that only

4:14 am

the traders kind of understand them. the chance that management understands it is already a lot smaller and that top management understands it is pretty remote. i think the products are too complicated, the banks are too large. it doesn't serve anybody. >> will this lead to more regulation, do you think? >> i think regulation is kind of in place and everybody's trying to do the best they can. the problem is, the products are so complicated that the management doesn't understand it and they can't be regulated almost. they're too complicated. so i think the only way to solve this is to make the banks smaller, for them to be, you know, smaller beasts almost. >> parliament is debating whether it should further regulate the country's banks by tightening the balance sheets. ubs was bailed out at the height of the crisis. had to raise 4 billion as a result of losses linked to the credit crunch. if you want to read more about the huge loss at ubs, what

4:15 am

caused it and what it could mean in terms of big changes in the way the bank operates, i've been blogging about that subject online. you can find it at cnn.com/biz360. logon and let us know what you think. >> do check out the blogs. they're fascinating. this is "world business today." stock prices moved up on that word that central banks will make dollars available. what does the liquidity plan boil down to in the long term? we'll find out. that's just ahead. in a matter . hi. hi. you know i can save you 15% today if you open up a charge card account with us. you just read my mind. [ male announcer ] just one little piece of information and they can open bogus accounts, stealing your credit, your money, and ruining your reputation. that's why you need lifelock. lifelock is the leader in identity theft protection. relentlessly protecting your personal information to help stop the crooks in their tracks before your identity is attacked. protecting your social security number,

4:16 am

your bank accounts, even the equity in your home. i didn't know how serious identity theft was until i lost my credit and eventually i lost my home. [ male announcer ] credit monitoring alone is not enough to protect your identity, and only tells you after the fact, sometimes as much as 60 days later. with lifelock, as soon as we spot a threat to your identity within our network, our advanced lifelock id alert system directly notifies you, protecting your identity before you become a victim. identity theft was a huge, huge problem for me. and it's gone away because of lifelock. [ male announcer ] while no one can stop all identity theft, if the criminals do manage to steal your information, lifelock is there to help fix it with our $1 million service guarantee. that's right. a $1 million service guarantee. don't wait until you become the next victim. call now to try lifelock risk free for 2 full months. that's right, 60 days risk free. use promo code: norisk. if you're not completely satisfied, notify lifelock and you won't pay a cent.

4:17 am

order now and also get this document shredder to keep your personal documents out of the wrong hands. a $29 value, free! get the protection you need right now. call or go to lifelock.com to try lifelock risk free for a full 60 days. use promo code: norisk. plus get this document shredder, free! but only if you act right now. call now! lifelock service guarantee cannot be offered to residents of new york.

4:18 am

live from cnn hong kong and london, this is "world business today." a warm welcome back. let's go back to one of our top stories this hour. stock indices worldwide have been moving up with news that several major central banks plan to loan u.s. dollars to commercial bankers. let's take a closer look at this particular move. the coordinated liquidity response will make sure that nonu.s. banks have access to all

4:19 am

the dollars they need as american lenders back away from europe's debt crisis in lending to some european banks. the money will be made available throughout ecb in a series of three-month loans. it all kicks off as of the 12th of october, my birthday. concerns over the ability of european banks to borrow dollars has been a major factor in some of the sliding share prices we've seen. as you probably well know, this has taken a huge hit on companies like societe generale and others. >> he points out that the restored confidence is helpful but doesn't really change the fundament fundamentals. >> it is a very bold step taken by the ecb, the federal reserve and some other central banks around the globe. not 100% sure it really ends the

4:20 am

euro crisis despite the excitement on wall street and in europe in terms of shares of big banks soaring on this news. it will help restore confidence in the fragile big european banks, particularly the french banks that got hit by a credit downgrade. but it doesn't really change the fundamentals in terms of greece still being very loaded with debt and facing a possible default if there is no swift action taken to help get greece in better financial shape. despite all the talk from european officials, including germany's angela merkel, this doesn't really make a difference, i think, in the sense that you still need greece to be dealt with. if they default, how is that handled? is it done in an orderly way? if it's not orderly, all this liquidity that's provided to the big banks, it may last for a few weeks or months even at most. that really didn't do the anything to change the negative picture for big european banks

4:21 am

and that's something i think a lot of people still need to be worried about. >> at a basic level things haven't really changed. that was paul la monica speaking from cnn money there. take a look at the cnn money website. right now it has a great read on the $76 billion cash pile apple is signature on and why it's not sharing the wealth with investors. take a look. on cnnmoney.com. manisha, it's quite possible some of our viewers will be looking that up on a tablet computer. with growth of nearly more than 300%, tablet computers are a hot trend. when we come back, we'll take a look at the ball are for market share in this booming sector. nationwide insurance, what's up ?

4:23 am

4:24 am

the next year... that was weird. but awesome ! ♪ nationwide is on your side good to have you with us. it's "world business today." here are some of the other top business stories we're following for you throughout the course of this show. the computer giant hewlett-packard may be facing a class-action lawsuit from shareholders. investors are furious about a series of major decisions such as, for instance, the closing of its touchpad line which caused hewlett-packard stock to plunge 20% in just one day. here's a horror story from the movie rental netflix. its customer base is shrinking thanks to rising prices.

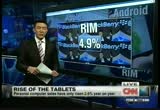

4:25 am

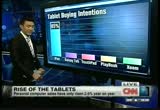

the company boasted almost 26 million customers at the end of the last quarter. three months later, it's forecasting 24 million customers. the company says its price increases are necessary to offset higher licensing costs. netflix ended thursday's trading session down almost 19%. research in motion watched its share price wither on the vine after it announce ed grim second quarter earniningearning. smartphone sales were also down for the period and now, rim's stock price is now just under $24 a share in after-hours trading. so say plunging on the back of that news. well, let's talk more about tablet computers. they'll expand their share of the market pie to 17% this year. this is according to idc, the london-based research firm. the growth in tablet computer

4:26 am

sales was 303% in the second quarter of 2011. it's a very big number. now, in the same time frame, personal computer sales grew at just a paltry 2.6%. but that growth in tablet sales doesn't mean an equal spread of wealth among companies. ramy inocencio has been looking at all of this and has details for us. it's ridiculous. i have two tablet computers. one has more tech than the other. >> you're driving up those numbers right there, manisha. looking at the big picture, tablet sales are set to keep that up growth trend. we see one big winner while others shrink or disappear from the tablet world. the 10.8 inch and 59.5 inch galapagos will no longer be sold, it's said. the line was only launched in december.

4:27 am

they samed to sell 1 million tablets but consumers haven't been all that interested. because they're just hasn't been much content developed for them. now, the shrinking of sharp follows hp's announcement just last month to totally stop production of its touchpad tablets. it's probably no surprise why sharp and hp are falling away. it's because of one company and that, of course, is apple. a recent report shows when consumers think that buy a tablet pc, they actually think of the ipad and that's about 85% of them. samsung's galaxy comes in at number two, just about 4% here. the touch pad and the playbook, not too far behind with just about 2% right here. research firm idc is april to june sales do bear out this statistic right here. nearly seven of every ten tablets sold in the second quarter of the year were ipads, that's up from about 66% in quarter one. meantime, android's market share

4:28 am

was this amount, 26.8% in the second quarter. down from 34% in the first quarter and this is expected to fall, actually, because of what's happening with the hp touchpad. and finally, research in motion, coming in at just under 5% in quarter two. there's no first quarter number because this launched in april. looking ahead, the new windows 8 operating system that was just launched has been getting pretty good reviews. it's geared for touch screens but it is in the product testing phase. we'll have to wait and see if it can take a bite out of apple. while you wonder that, we'll take a quick break right now. this is "world business today." we'll be right back. and tastes simply delicious. for those of us with lactose intolerance... lactaid® milk. the original 100% lactose-free milk. at aviva, we wonder why other life insurance companies treat you like a policy, not a person.

4:29 am

4:30 am

4:32 am

from cnn london, i'm nina dos santos. >> and i'm at cnn hong kong. a warm welcome back to "world business today." this just in to cnn regarding manchester united's initial plan for an ipo. they know the singapore stock exchange has given manchester united the green light to go ahead with that initial public offering. manchester united has to decide whether it wants to go public. they have about six months from their last audit which actually took place in june. however, they can update that audit and then extend it by another six months. of course, going public during these turbulent times, requires perhaps nerves of steel. some investors have said. we have to see whether manchester united decides to go ahead with that initial public offering. so far has been approved by the singapore stock exchange. manisha? two hours ago india raised

4:33 am

interest rates for the 12th time in 18 months. the central bank is trying to rein in rising prices. the stunted growth is already showing signs of slowing. sara sidner is in new delhi and can tell us more about this. yet another rate hike. what is it going to mean for people there? >> you mentioned it. it's the 12th time in a year and a half that the reserve bank of india has taken the rate and brought them up. of course what they are trying to do is deal with this increasing nagging headache that indian citizens have had to deal with and that consequently puts it on to the politicians running the country. that is the raising cost of food and commodities and fuel. just yesterday, fuel went up threes per liter.

4:34 am

that's nothing to sneeze at. they have the highest inflation numbers in august at 9.78%, the highest of the year. the government is trying to keep that number from coming a double digit number. they're looking at this as a way to moderate growth. you look at this from the perspective of every day citizens. they have to buy food, fuel, cooking oil. when these prices go up and you don't have rises in salary, it really is a crush together poor population and it really puts the middle class in a difficult situation where they're having trouble making ends meet. the government trying to balance growth and balance the rise of prices for the everyday average citizen, manisha. >> yeah, it's incredible, really because the growth rates are running at more than 7%. that's the lowest we've seen in some quarters. meanwhile, we've been hearing about flooding in delhi today. and what's interesting about this is agriculture is so important for the economy. how has it coped with unpredictable weather? all these sorts of things that

4:35 am

might impact upon growth moving forward? >> yeah, i think when the monsoon comes, people generally assume there will be a bit of flooding, especially in the capital where a lot of things don't get cleaned out properly. you have flooding in the streets. it goes up and down. you have a great burst of rain. this year for a while there, the capital was really under. they didn't have as much rain as they needed. now they have sufficient rain. but there has been a lost frustration for people who are trying to get goods to and fro. and the average citizen trying to get to and back home from work. there are going to be problems but we really need this rain. we're trying to work on that. there's a lot of issues when it comes to trying to get goods to and from where they need to go. that is one big one during the monsoon season. there have been floods in erisa, that have been quite devastating, killing 20 people. it's something india has to deal with. you need the rain for agriculture and to help wipe out

4:36 am

the dust in the city but it can cause a bit of a problem. but monsoon season is just about over here. >> thanks so much. sara sidner in new delhi. let's stay with the region now and tell you about more flooding in pakistan. the river has burst its banks leaving many hectares under water. good morning to you, i'ven. >> good morning. it looks like essentially a big lake, not a river here across pakistan. unfortunately we had the same problem last year. and sara's point there as well which mentioned the monson retreating, it's not retreated. it's late in retreating. we're still raining on top of these folks. we take you back to september of 2009. i can't take you back to last year because last year we had unbelievable flooding here as well. this is the way it's supposed to look. this is the river flowing down to the south. take a look at what happens when i forward this into motion. you can see it's just engorged here. of course, people live where you

4:37 am

see the blue there. you want to live near the river, right? that's what a lost us do so we get close to the river and look at what can happen here as we continue to rain upon the region. this is badin, 300 kilometers east of the indus. take a look at what happened here. the flood plain doing what it's supposed to do when you get too much rain. that is what happens here. those folks that have been impact have had now reached, of course, the millions. we talked about this last year, sinn province has been the largest hit, 7,000 square kilometers of crops have been impacted, 64,000 livestock has been lost. talk about the humanitarian aspect of it, 5 million people affected. almost a million homes have been damaged either partially or

4:38 am

completely destroyed. that's why we have upwards of 250,000 people right now in shelters. i do want to get to the forecast real quick. we are seeing the monsoon slowly withdrawing. that means more heavy rain, more of what we saw through the month of september is going to continue. the the damage has been done even if we shut off the rain today, this is not going to happen. nina? >> ivan cabrera joining us from the cnn international weather center. many thanks for that. the eu tries to get a handle on the debt crisis, spain is trying to reintroduce a controversial wealth tax today. the spanish government hopes the move will not only preven it the from being the next victim of the crisis but also it will shore up a huge budget gap for the country. taking the brunt of the downturn in spain. thousands ever small businesses have begun bankrupt as a result of the economic crisis. he caught up with one owner, he's fighting a daily battle just to stay afloat.

4:39 am

it's a 0-year-old family business. facing perhaps its toughest challenge. >> translator: i have never seen anything like this crisis. there's like a movement. it's absolutely vital to invent solutions day by day. >> reporter: and jose feels the pressure to do just that. his company supplies frozen vegetables, its premium product but also distributes bulk, canned vegetables, about 700 food items in all to hotel kitchens, restaurants, government-run hospitals and schools up and down the mediterranean coast from its home base. but it has been no fun laying off 11 workers, about 10% of the staff. he's outsourced much of his costly trucking operation. >> translator: fuel prices are up about 46%. transportation is 30% to 40% of the cost of our products. so transportation is where we

4:40 am

have cut costs the most. >> reporter: to keep the business going during the crisis they've had to watch the costs very closely, pallet by pallet, kilo, kilo, pound by pound. in the front office the belt tightening means reduced margins and trying to collect from customers who are slow to pay. >> translator: it's not just the customers who don't pay. it's the late payments from government agencies which are a big client of ours. >> reporter: no matter how carefully the company tries to wrap up all the challenging details, he says he has no control over the underlying problem, demand is weak. >> translator: consumption has to return somehow so the economy will work again. here we need tourists from southern england to earn a lot of money and come here on vacation. >> reporter: the government says tour six beginning to rebound. but for small businesses like this one, it's a long road to a full recovery.

4:41 am

al goodman, cnn, bennie durham, spain. let's take a look at how the european stock markets are moving. the markets have been open for just under an hour and three-quarters. this is how they're faring, with the exception of the cac 40, most of the indices rises on the back of concerted central bank action to provide liquidity to the world's euro zone banks in dollars. manisha? >> u.s. stock markets look set for a lower open when trading gets under way on friday. this is where the futures stand in that premarket action. somewhat different to what we've been seeing elsewhere. we've seen a pep up for the major markets here in asia. that's it for this edition of "world business today." good to have you with us. >> i'm nina dos santos in london. see you next time. in the mean i'm, have a great weekend, whatever you do. [ woman ] jogging stroller. you've been stuck in the garage

4:42 am

4:43 am

4:45 am

this week on "marketplace middle east," reigniting new ties with old al lies. turkey's prime minister was on the defensive. and the g8 and the gcc countries come together to pledge a further 18 billion today's help rebuild the economies of arab nations moving towards democracy. but will the funds arrive fast enough? the arab spring has shaken alliances across the middle east and north africa.

4:46 am

amid the scramble to forge new partnerships, israel looks like it's drawing a losing hand. turkish prime minister received a hero's welcome on a visit to cairo this week. it was his first stop in a three-nation tour of north africa. he's looking to build stronger takes with his arab neighbors, particularly egypt. but as ivan watson reports, israel's relation with both countries is worsening. >> reporter: an angry mob attacks the embassy of israel in cairo on the night of september 9th. tearing down walls and forcing israeli diplomats to leave the country. the riot triggered a diplomat crisis among two allies. in cairo, reactions mixed. "this shouldn't have happened. it was a sin to destroy property and attack the police," this man says. the israelis are our enemies says another man. egypt's gotten a lot more

4:47 am

unpredictable since last winter's people power protests toppled authoritarian president hoseny mubarak. it didn't help matters when israeli troops accidentally killed six egyptian border guards after a deadly terrorist attack left eight israelis dead last month on nearby israeli soil. israel expressed regret but still hasn't at poll hissed for the incident. then there's another factor, turkey. until recently israel's closest friend in the middle east. but the turkish government is furious that israel won't apologize for eight turks and one american killed last year by an israeli commando raid against an aid convoy that was trying to bust the israeli blockade of gaza. this year, the prime minister killed out the ambassador and suspend all military agreements with israel. some protesters carried posters of the turkish prime minister. >> did the turkish actions

4:48 am

provoke the people at all or inspire them? >> yes. definitely the egyptians start to make comparison between what turkey did and what egyptian government did. and at the end of the day they want action. >> reporter: the increasingly popular turkish leaders' visit is likely to put more pressure on the egyptian government to take a more assertive stance in its relations with israel. >> he also has a big aimage in the region which ask new to turkey, exciting, almost intoxicating for the turkish ruling class. they've never had this kind of reaction from the middle east in living memory and it's something which we don't know quite where it will go. >> reporter: it's as unpredictable as the arab spring uprisings which are transforming the middle east and redefining relations between america's three biggest allies in the region, turkey, israel and egypt. ivan watson, cnn, cairo. with the changing preliminary dimensions of the middle east, economic landscape is suffering.

4:49 am

and funding for the recovery process is needed urgently. international community has promised $38 billion in financing for egypt, tunisia, morocco and jordan. that's almost double the $20 billion agreed upon by the g8 back in may. but the imf says the cost of recovery for those economies is more than $160 billion. and despite the promises, much of the money has yet to be delivered. i spoke to egypt's finance minister and asked him how important it was to see the funding this year. >> of course any funding is welcome always. but i don't think we expect to see some concrete proposal as to amount of money to be located. but the idea is to show that the g8 and the other countries are supporting the countries in the middle east or are undergoing this major change.

4:50 am

both politically and economically. >> one would argue if you look at the crisis that you have on your hands right now that nobody's moving fast enough to meet the needs of egypt because of the size of the economy. >> yes. because of this situation of the global economy, our problems came at a time where everyone else has its own problem. available finance is not easy in the context, however, one should also mention in this very difficult financial situation, there is a kind of firm commitment from many countries to help boost egypt and tunisia. >> in particular saudi arabia. >> saudi arabia definitely and some other countries. >> how do you move from this vantage point of a country that attracted $50 billion of foreign direct investment in a window between 2005 and 2010 and in a crisis of political upheaval, bringing them back? >> uprising, changing political situation, not only in egypt but the whole region.

4:51 am

the only safe position is -- of course we need immensely the financial support. it is helpful. it is important. but on the other hand, we understand. >> this is interesting you bring it up. we have two case studies right before our eyes in tunisia, former president ben ali fled the country. what will history suggest is the better outcome to have a president leave so you can put history behind you or to have justice served? >> i can give you an answer what the history will say but i can feel that for egyptian next generation, it is very important to have in their history that the people succeeded to bring

4:52 am

former president to trial. not only to try but before his -- >> it will not scare off investors for a longer period of time in your view? >> it will comfort them when they say after the revolution and when we wanted to try someone, he's tried according to the law. >> isn't the reality, not just in egypt but tunisia, syria, yemen, bahrain, that the situation will get much worse before it gets better in terms of job creation for those unemployed right now? especially the youth? >> of course. there is so many changes which will appease their anxiety in terms of more justice, more transparency, more commitment to their causes. but to see tangible concrete things in their hand it will take some time. >> the interim finance minister of egypt. coming up next, the impact of the syrian crisis on its neighbor, lebanon.

4:53 am

an interview with the lebanese finance minister is next. ysis. . ysis. . i trade on tradearchitect. this is web-based trading, re-visualized. streaming, real-time quotes. earnings analysis. probability analysis: that's what opportunity looks like. it's all visual. intuitive. and it's available free, wherever the web is. this is how trade strategies are built. tradearchitect. only from td ameritrade. welcome to better trade commission free for 60 days when you open an account.

4:55 am

the european union is the biggest buyer of exported syrian crude with several european companies like royal dutch shell and totale invested in syria. now the economic pressure is building on the regime. they founded another round of sanctions that would prevent oil companies from signing new deals in syria.

4:56 am

the new sanctions would follow an eu embargo on syrian oil exports that's already in place. one country that's watching developments in syria closely is its neighbor, lebanon. country's finance minister says its economy depends on how the syrian crisis is resolved. >> as long as the change in syria is done in a controllable way, then we're fine. >> big, big question mark, though, is it not? >> god forbid if there is a spillout in syria, things went out of hand, you know, things went crazy there, we would suffer, yes, of course. >> do you think that the international community understands how syria could potentially unfold? >> i think the american administration may be have got two different ideas. one view, i think, is let what

4:57 am

happen, happen. you know? we'll deal with it as it does happen. and the other view is that, no, what might happen could spill on a lot of other areas and we should really make sure that we don't let it spill. so as long as the change is controlled, we are fine. >> is it fair to say that it's been the damascus and aleppo business communities that have stood behind president assad and that's why he hasn't tumbled yet? >> up till now, yes, it is true. >> do you think that will change? are we near a breaking point. >> there are also a lot of the youth who are still in support of president assad. >> from your vantage point can that hold, can that support hold for him? >> it's not a matter of syria holding or not holding indefinitely. there's a change. the people want a change. now, what's important is that

4:58 am

that change ends up into exactly where the people want, freedom and more jobs. democracy and more jobs. if it doesn't end in that, it means that change is disastrous. >> once again, mohammed safadi from lebanon. send comments by e-mail to mme ats cnn.com and check out our web page in arabic at arabic.cnn.com/mme. i'm john defterios, thanks for watching. we'll see you next week. -- captions by vitac -- www.vitac.com

214 Views

IN COLLECTIONS

CNN Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11